Know Your Investor: Google Ventures

Shots:

-

An investment arm of Alphabet Inc., Google Ventures Management Company colossally in seed stage companies, in diverse fields ranging from software and internet to healthcare, life sciences, and artificial intelligence among others

-

Since 2016, GV has shifted its focus from seed-stage companies to evolved companies. With over $8B worth of assets under the management and 400 active portfolio companies, the company has invested in over 65 IPOs and 175 M&As

-

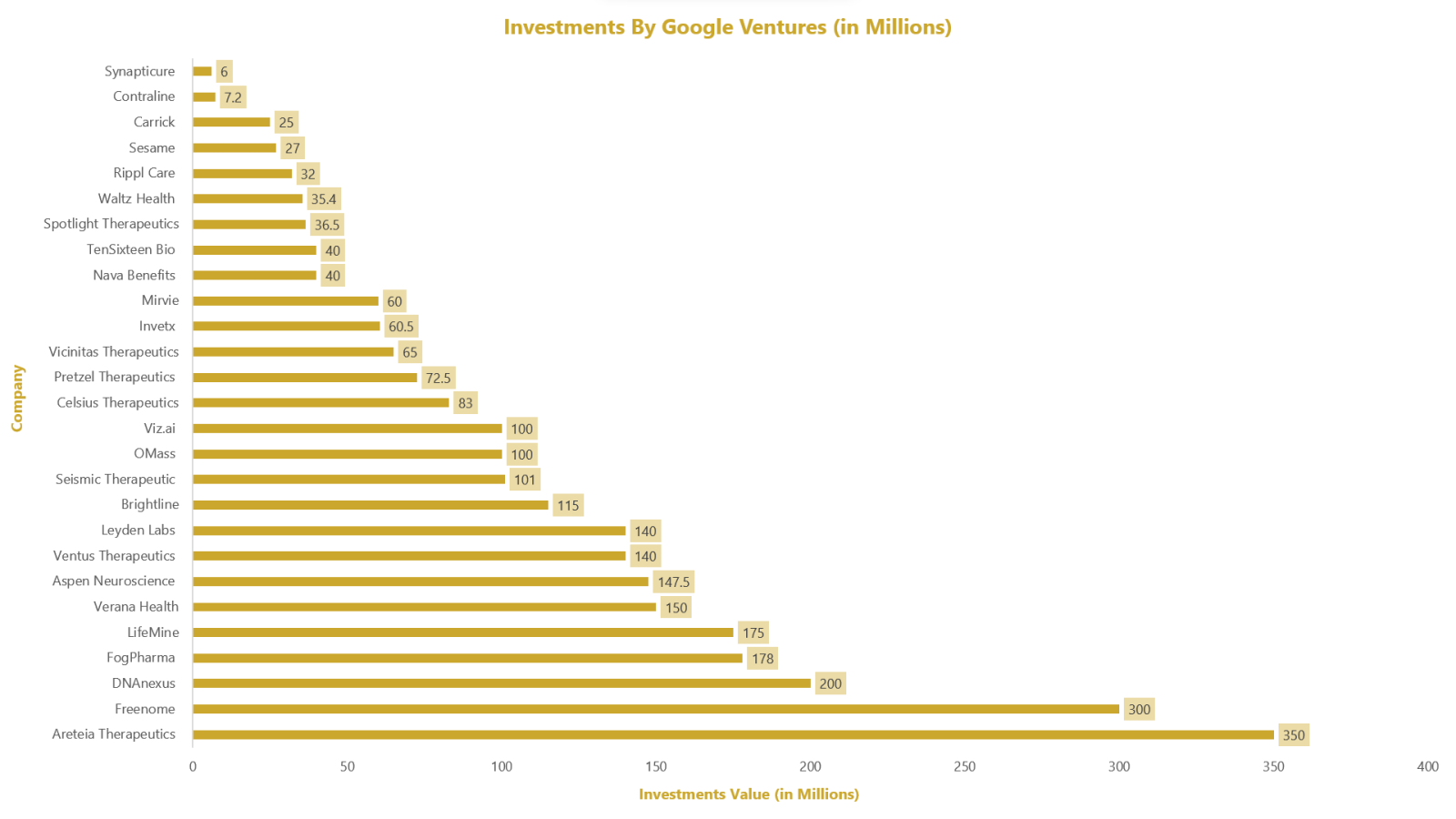

In 2022, Google Ventures participated in 27 investments with Areteia Therapeutics receiving the highest amount of funding worth $350M

Google Ventures (GV)

Founded in 2009 by Bill Maris, Google Ventures (GV) is an integral part of the renowned Alphabet. Its headquarters is located in San Francisco, United States, while its offices are located in areas including New York, Cambridge, and London. The company made its first investment as a venture capital firm to Silver Spring Networks and Adimab. The operating partners of GV assist companies in the areas of talent, engineering, equity, diversity & inclusion, and design. GV also facilitates companies' interactions with Google.

GV invests in startup companies that function in a variety of fields ranging from Internet, Software, Hardware, Life Science, Healthcare, Artificial Intelligence, Transportation, Cyber Security, and Agriculture. Currently, GV has over $8B in assets under management, with 400 active portfolios and companies across North America, and Europe, and has a notable investment outcome including Uber, Nest, Slack, GitLab, Duo Security, Flatiron Health, Verve Therapeutics, One Medical.

The firm is majorly associated with investments made in Seed, Series A, B, C, and D rounds. Areteia Therapeutics, Aspen Neuroscience Inc., Synapticure Inc., Brightline, OMass Therapeutics Ltd., Contraline Inc., and Carrick Therapeutics Ltd. are among GV’s portfolio companies. In 2022, Areteia Therapeutics received the highest amount of funding worth $350M.

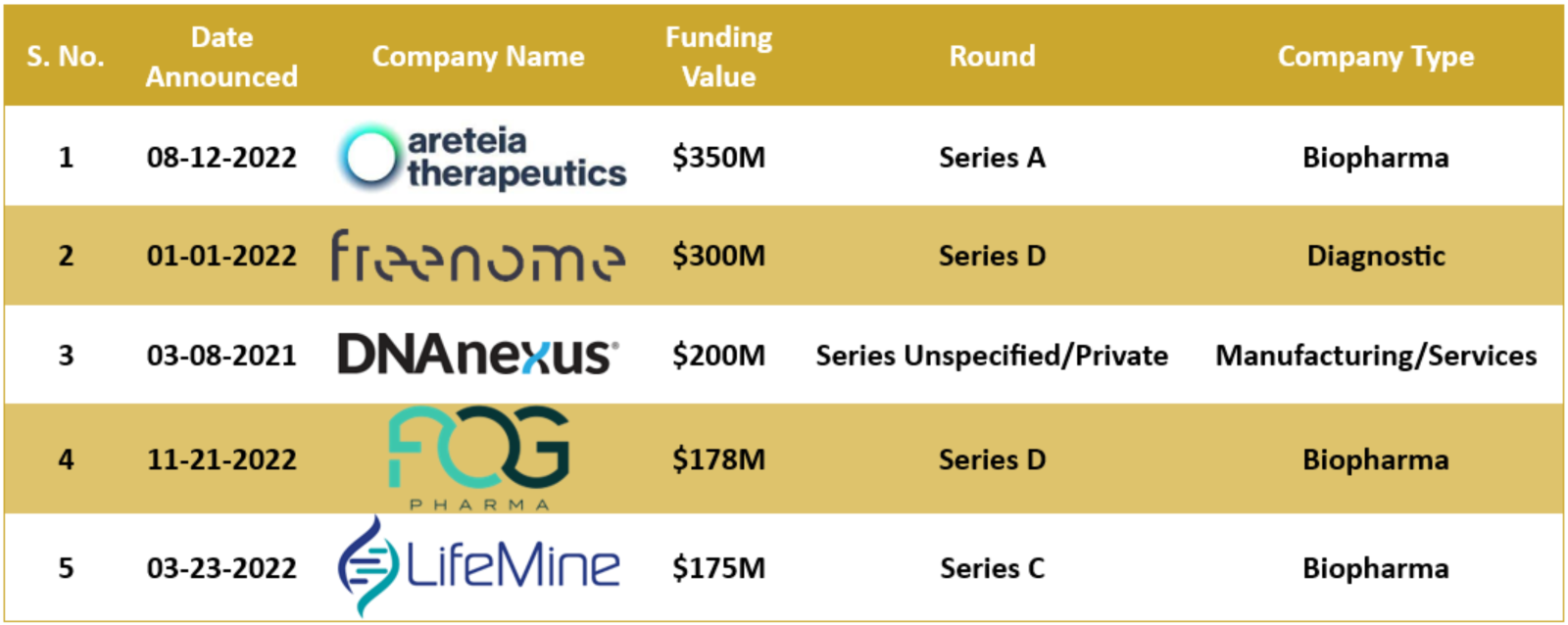

In 2022, about 27 investments were closed by GV ventures in the Life Science and Healthcare Field. These investments were mostly made in Biopharmaceutical companies, Diagnostics, and Manufacturing or Service Providers. Out of the 27 investments made, 15 fundings with Biopharma companies were closed by GV in 2022. The treatment areas that were emphasized by the companies were Autoimmune, Oncology, Genitourinary, Infectious Diseases, Inflammation, Neurology, Ophthalmology, etc. Moreover, GV invested in a variety of technologies, including Artificial Intelligence (AI), Machine Learning (ML), Antibodies, Diagnostics, Digital Health, Gene Editing/CRISPR, Protein-based therapies, DNA-based therapies, Small Molecules, etc. Additionally, 33% of GV’s total investments in 2022 were made under Series B, whereas 22% were made under Series A. The top 3 investments made by Google Ventures are as follows:

- Series A funding worth $350M to Areteia Therapeutics

- Series D funding worth $300M to Freenome Inc.

- An Unspecified/Private funding worth $200M to DNAnexus Inc.

During the first quarter of 2022, Google Ventures participated in around 12 funding rounds, 8 during the second quarter, 4 during the third, and 3 funding rounds during the fourth quarter. Out of these fundings, the highest investment was made in Biopharma companies, including LifeMine Therapeutics, Areteia Therapeutics, Celsius Therapeutics, etc.

Google Ventures invested heavily in companies developing therapies associated with Small Molecules out of which LifeMine Therapeutics received a total of $175M from GV, while Ventus Therapeutics earned $140M, OMass Therapeutics Ltd. received $100M, and Carrick Therapeutics Ltd. received $25M.

The following table represents the top 5 funding rounds out of the 27 investments made by Google Ventures in 2022. (For a complete report, reach out to us at connect@pharmashots.com with the subject line "Google Ventures")

Related Post: Know Your Investor: Alexandria Venture Investments

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.